ClearChoice provides a branded online retail platform for credit unions that offers interest-free shopping to credit union members without the need for a credit check, creating new revenue streams for credit unions and giving customers an interest-free way to purchase the things they need through the financial institution they already use, know and trust.

As credit unions struggle to create new revenue streams, ClearChoice couldn’t come at a better time. And with customers trapped in a cycle of debt caused by rent-to-own stores, payday loan sharks and high-interest credit cards, ClearChoice offers a clear way out. It’s a win-win.

For years, credit unions have struggled to create new areas of growth to stay relevant to their loyal members.

ClearChoice offers credit unions a way out: a new revenue stream that steals market share from rent-to-own stores, payday loan shops and high-interest credit cards. It’s an entirely new, proven growth strategy that just happens to give credit union members exactly what they need in the process.

Big and small. expected and unexpected. All credit union members face financial hurdles. But they don’t all have access to the same financial resources.

The ClearChoice Member Purchase Program was designed specifically for that reason. It allows credit unions to serve their core members—when they need help the most—while relying on their credit union membership, not just their credit score. A cutting-edge, one-of-a-kind benefit, it’s a clear win-win.

ClearChoice works similar to reverse layaway, giving members the freedom to make important purchases safely.

No interest. No finance charges. No hidden fees.

It’s a remarkably simple—and financially sound—solution that benefits credit unions and its members equally.

The ClearChoice solution is made possible through an innovative combination of product shopping and a behavior-based underwriting loan algorithm that allows financial institutions to safely offer pre-approved, interest-free loans for everyday household items.

First, it drives new core member growth. Who wouldn’t want to use a credit union that gives its members an interest-free option without any fees or gimmicks?

Second, it generates a new source of revenue via product commission from each loan package.

Plus, it’s easy to implement and regulatory-friendly.

Generate a new source of revenue (interest and non-interest) and loans

Generate a new source of revenue (interest and non-interest) and loans

Increase your core membership

Increase your core membership

Provide a new benefit to members that’s valuable and regulatory-friendly

Provide a new benefit to members that’s valuable and regulatory-friendly

Stay in control of a program that’s easy to implement and maintain

Stay in control of a program that’s easy to implement and maintain

Protect your credit union while protecting your relationship with your members

Protect your credit union while protecting your relationship with your members

Designed to ensure responsible borrowing, ClearChoice focuses on core membership instead of relying solely on credit history. It’s a manageable, worry-free and interest-free loan with automatic debit payments (ACH) that helps members when they need it most and gives them access to a huge selection of premium products- products priced at or below retail.

Choose from a wide range of major household products at or below retail prices

Choose from a wide range of major household products at or below retail prices

Make necessary purchases responsibly with no interest and no fees

Make necessary purchases responsibly with no interest and no fees

Pay off purchases quickly and conveniently

Pay off purchases quickly and conveniently

Improve credit scores

Improve credit scores

The ClearChoice Platform

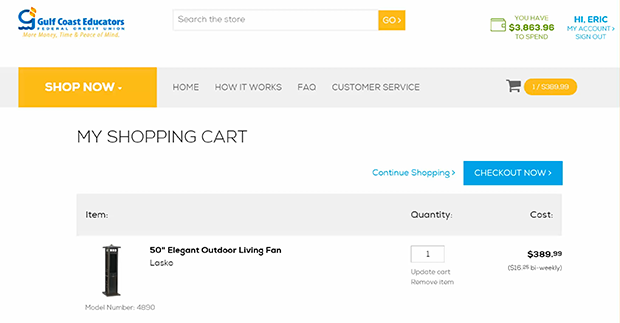

- The automated e-commerce platform ties into E-Docusign and an automated ACH processor to automate pre-approval and payments

- Data is imported automatically, and once the algorithm crunches the numbers, it provides a clear credit limit

- Customers then purchase items through the branded site and finance items over 6, 12 or 18 months

Account Verification

Account Verification

Your members verify their account against a pre-approved list that your credit union provides.

Shopping and Payment Terms

Shopping and Payment Terms

After selecting products, members choose payment terms that best fit their budget (6, 12, 18 months).

Loan Funding and Shipment

Loan Funding and Shipment

The loan is funded and products are shipped automatically to your members.

Payment Deductions

Payment Deductions

Your credit union’s semimonthly payments are automatically ACH’d from your members’ account.

ClearChoice is the obvious path to growth for credit unions, and soon, for almost any financial institution.

We’ve worked with product vendors, integrated an electronic signature company and connected to an ACH processor to make that happen.

The same month we completed that process—December 2014—we signed our first beta client. Ten sales immediately followed, and in July we signed two more credit unions to bring us to total of 4,500 eligible loan shoppers.

Since then, we’ve signed our largest client to date- Gulf Coast Educators Federal Credit Union and their 40,000 members and 18,000 eligible shoppers.

That brings us to 23,000 eligible shoppers on the ClearChoice platform heading into the New Year.

And that’s just the beginning: we’ve got a pipeline of about 90 credit unions lined up. We’ve also partnered with a well-known credit union broker group, kicked off talks with Cornerstore (which has hundreds of credit union clients) and struck up relationships with drop-shippers, wholesalers and manufacturers to handle customer purchasing needs.

ClearChoice is now a reality.

But credit unions are just the beginning- banks are a natural extension of the ClearChoice platform, and several other opportunities are waiting in the wings.

Want to hear more? Click the “business profile” tab at the top of this page to find out how ClearChoice plans to expand.

Eric has over 25 years of experience across various industries, including two start-ups (MyPoints.com and CultureWorx), both based on incentive points systems with similar shopping experiences as the ClearChoice Program, sports marketing, franchising and professional services. He’s worked with small organizations and large organizations such as the White Sox, RainSoft Water Treatment Systems, and McGladrey where he innovative several marketing strategies and operations.

Andy has over 22 years of experience across various industries, with the most relevant experience in the Employee Purchase Program industry, which is what ClearChoice is based on. Experienced in the pharmaceutical and insurance industry he understands customer service and building sales through a channel partner. He served as Manager of Voluntary Products and Provider Services for Health Administration Services (H.A.S.) in Houston, Texas. At H.A.S., he managed Flexible Spending Account products, built custom provider networks for clients and achieved rank as a top broker producer for Colonial Supplemental Insurance.

Justin has over 15 years of experience having success in roles that range from Project Manager, Sales Executive, and Director of Operations. During the early part of his career, he worked as an inside sales executive and an operations manager for one of the largest healthcare staffing companies in the United States. His primary responsibilities were to market the company’s services to large and small healthcare facilities throughout the country as well as being fully accountable for the control of operations, quality, and customer service at both on-site and off-site locations.

ClearChoice provides a branded online retail platform for credit unions that offers interest-free shopping to credit union members without the need for a credit check, creating new revenue streams for credit unions and giving customers an interest-free way to purchase the things they need through the financial institution they already use, know and trust.

See Campaign: https://www.fundable.com/clearchoice

Contact Information:

Eric Webb

Andy Hillyer

Justin Meier

Tags:

Fundable, Equity, United States, English, Internet, Computers and Software, Colorado, Industry verticals, Regions, Types of Crowdfunding deal, Language

Source: ICNW

Related Post

Entradas recientes

- BCP Global Lanza Portafolios de iBonds Utilizando los iShares iBonds™ de BlackRock 9 abril, 2024

- La Iglesia Shincheonji celebra 40 años de historia sin detenerse 21 marzo, 2024

- La Resolución de Conflictos Internacionales y la Institucionalización de la Paz Discutidas en la 8va Conmemoración Anual de la Declaración de Paz y Cese de la Guerra de HWPL 20 marzo, 2024

- 2RMD ofrece uno de los mejores doctores de trasplante capilar en Colombia 11 marzo, 2024

- Corea del Sur concede a Lleida.net su sexta patente en el país 4 marzo, 2024